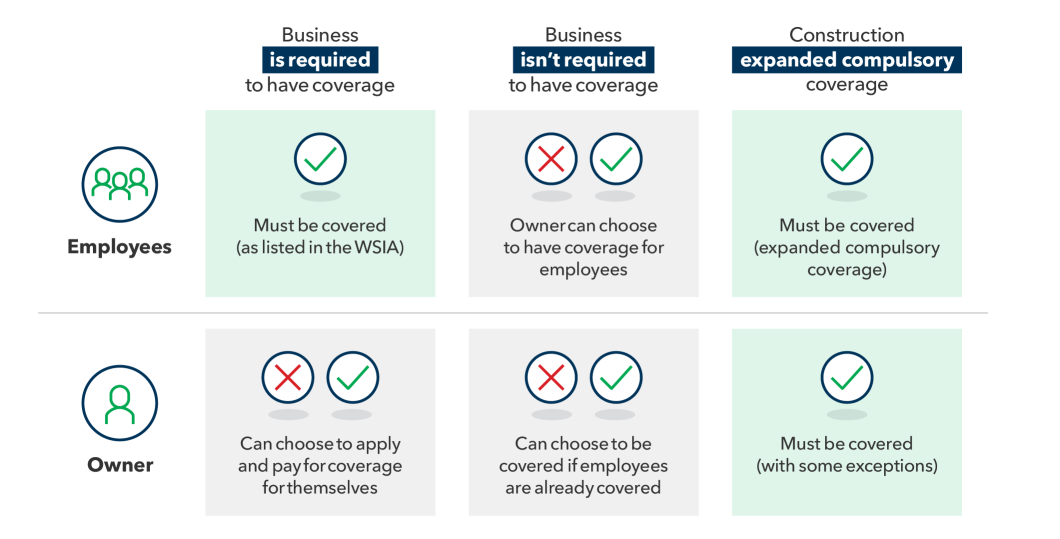

WSIB coverage isn’t mandatory for everyone in Ontario. The Government of Ontario decides which industries and which types of employees have to have WSIB coverage, and lists them in the Workplace Safety and Insurance Act (WSIA).

If a business isn’t required to have coverage, but wants it, they can apply for coverage for their employees.

Once a business is registered with us, their premiums cover the employees, but not owners (except for most construction businesses).

Owners (partners, sole proprietors, independent operators and executive officers) can apply for WSIB coverage for themselves, as long as they have coverage for any employees they may have (the process is the same whether they’re required to have coverage, or they choose to have it).

Please note that WSIB coverage is the same for every business registered with us, whether they’re required to have coverage, or they choose to have it. Coverage lasts for a minimum of three months, and will not end until you cancel it.

Applying for coverage for employees

If you’re not required to have WSIB coverage, but want it for your employees, you must complete the following steps:

- Step 1: Register with the WSIB – this process is the same for all businesses, whether they’re required to have coverage or not. You will need to sign up for online services and then use the registration service to register your business. Here’s a checklist with all of the information you need to register.

- Step 2: We'll review your application, making sure that we have all the information we need, and that your business isn’t required to have coverage under the Workplace Safety and Insurance Act.

Step 3: We'll reach out and ask you to fill out an

or an depending on the industry you’re in.- Step 4: We’ll review your Employer by Application form. If we have all of the information we need, we’ll complete your business’ registration and activate your account.

- Step 5: You will receive a registration package from the WSIB in the mail that includes your account number, a safety poster and information on doing business with the WSIB.

Applying for coverage for an owner

If your business has WSIB coverage, and you also want it for the owners, (whether they’re partners, sole proprietors, independent operators or executive officers), here’s what needs to be done:

- Step 1: Get coverage for your employees (if your business has employees besides you).

Step 2: Fill out and submit an optional insurance request/change form for each person who would like coverage.

Step 3: We’ll review your optional insurance request/change form and if we have all of the information we need, we’ll complete the registrations.

- Step 4: You will receive a letter that confirms your registration and lets you know what the pro-rated premiums are for the rest of the year. This will be based on the amount you report for your insurable earnings, and when in the year you applied for insurance.

Important information about the optional insurance request/change form for owners:

- Someone who has the legal authority to sign agreements on behalf of the business must sign the form.

- The form will ask you how much insurance you’re requesting. We recommend that you request the amount that best reflects your annual salary (which we will consider your “insurable earnings”).

- Please note that we have an annual maximum for each person’s insurable earnings, meaning you don’t have to pay premiums on anything above the annual maximum.

- If you’re just starting out, your salary will be difficult to estimate, so we have developed a few best practices to help you out:

- For sole proprietors and partners in a new business, your annual wage will be estimated at one third (33%) of our annual maximum.

- If you’re an executive officer and have a new corporation, your insurable earnings will be set at the amount you request, but will not exceed the annual maximum.