Understanding the basics

Schedule 2 organizations are self-insured and liable to fund all benefit payments for their injured employees and the associated administrative costs. Schedule 2 organizations are classified under three groups for the purpose of billing the administration charges:

- provincially-regulated organizations

- federally-regulated organizations

- organizations covered under the Government Employees Compensation Act (GECA)

The WSIB bills organizations in these groups each month for their benefit payments and the associated administration expenses using the applicable administration rate.

Outlined below are the steps involved in determining the administration rates.

Step 1 – Determining administrative expenses for Schedule 2 organizations

We take the total Schedule 2 expenses and allocate them among the three groups of organizations proportionally based on the benefit costs of each group.* We also allocate collective expense items applicable to Schedule 2 organizations (such as interest on delayed payments, benefit overpayments and more).**

*Note: Costs related to prevention division expenses, the Occupational Health and Safety Act and Ministry of Labour, Immigration, Training and Skills Development are only allocated to provincially-regulated organizations

**Note: Bankruptcy costs are not allocated to GECA organizations.

Step 2 – Determining the administration rate for each employer group

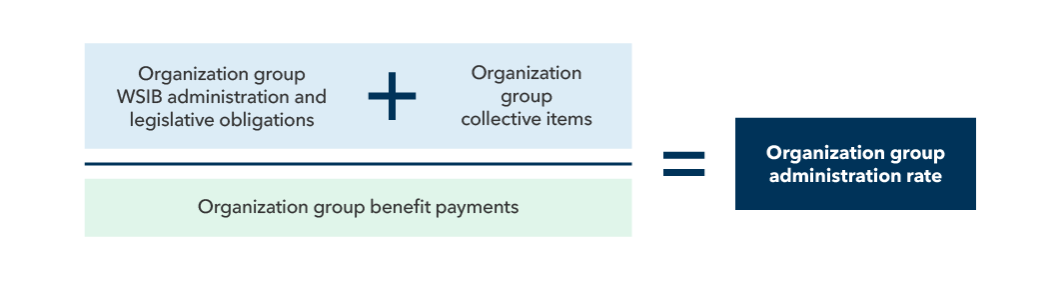

We determine the expenses for each of the three Schedule 2 groups and determine the administration rate to charge by using the following formula:

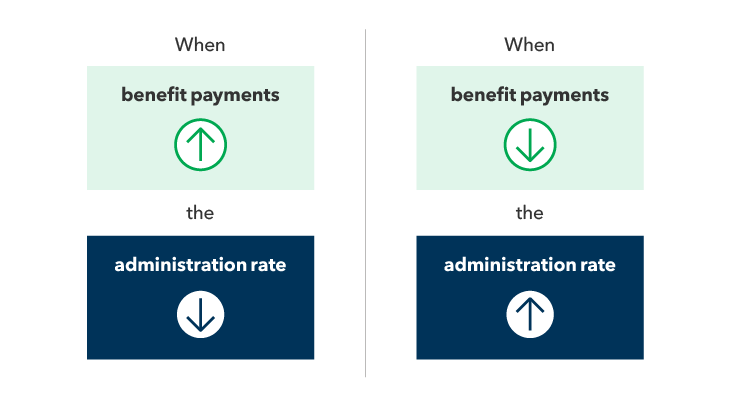

Remember: Because the administration rate is a percentage of administration expenses divided by benefits paid, when benefit payments for a group go up, the administration rate goes down. When benefit payments go down, the administration rate goes up. It’s important that organizations consider the administration rate as a whole instead of focusing solely on expenses or benefits in isolation.

Schedule 2 rate-setting cycle

Schedule 2 organizations pay the full costs of their WSIB claims and an administration fee to manage their claims.

We estimate the annual costs of running the Schedule 2 system at the beginning of each year to calculate the administration fee for Schedule 2 organizations. That’s when we provide Schedule 2 organizations with an estimated or “provisional” administration rate.

The following year, we provide organizations with their actual rate based on final data from the previous year. At the time, we either charge or credit organizations any difference between the provisional and actual administration rates as a one-time adjustment.

We have three key communications about Schedule 2 administration rates:

- Provisional administration rates – Set at the end of the previous year based on forecasts for the year ahead and used to charge organizations on a monthly basis. For example, the 2022 provisional administration rates were set in 2021 and posted online in early 2022.

- Latest forecast – Communicated at the same time as provisional administration rates based on updated information about the year prior. For example, when we communicate the 2023 provisional administration rates, we also include the latest forecast of the 2022 administration rates.

- Actual administration rates – Communicated in August of the next year based on final financial figures. We may make an adjustment to reflect differences between the provisional administration rate and the actual administration rate. The actual administration rate for 2022 is communicated in the summer of 2023.

Key terms

Actual administration rate: The actual administration rate is determined after the year ends, once the financial statement audit process is completed. An adjustment may be made to reflect differences between the provisional administration rate that was billed to organizations and the actual administration rate.

Administration expenses: Schedule 2’s share of the WSIB’s administrative expenses is based on the latest budget for the administration of Schedule 2 claims.

Benefit payments: Schedule 2 organizations are self-insured and liable to fund all benefit payments for their injured employees and the associated administrative costs.

Collectively charged expenses: There are collective expense items applicable to all Schedule 2 organizations such as interest on delayed payments, benefit overpayments and more.

Latest forecast: A latest forecast of the administration rates is communicated along with the next year’s provisional administration rates based on updated information.

Legislative obligations: The WSIB includes legislative obligations when determining Schedule 2 rates.

This includes the Occupational Health and Safety Act (OHSA), Workplace Safety and Insurance Appeals Tribunal (WSIAT) costs and Ministry of Labour, Immigration, Training and Skills Development costs when applicable, among others.

Provisional administration rate: A provisional administration rate for a year is determined before the start of the year. This rate is charged to Schedule 2 organizations based on their benefits paid on a monthly basis throughout the year.

Schedule 2 administration rate: The Schedule 2 administration rate is determined for the purpose of collecting the appropriate portion of administration expenses and collective items attributed to Schedule 2 organizations.

For more information

Please contact us at 416-344-3646 or toll-free at 1-800-387-0750, Monday to Friday, from 7:30 a.m. to 6:00 p.m., if you have questions about your administration rate.