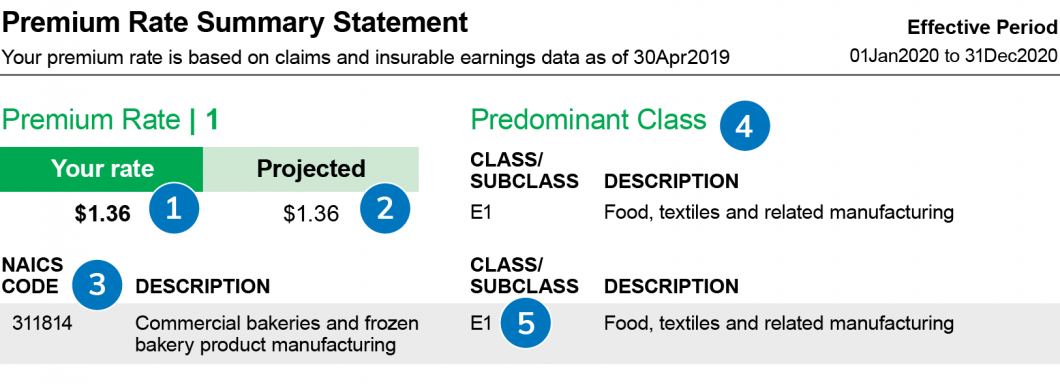

Your premium rate summary statement provides your current premium rate details and what they're projected to be in the future.

The sample statement explains the key terms found in the premium rate section of your statement.

Sample Statement

- Your rate is the actual rate that you will pay.

- Your projected rate provides the future direction that your rate is headed if there is no change in your individual and class experience from year-to-year. See our understanding your 2020 premium rate page to learn more on how you will move to your projected rate over time.

- Your NAICS code is a six-digit classification reflecting your business activities.

- Predominant class refers to the class/subclass with the highest portion of insurable earnings across all accounts within your organization and/or associated organizations.

- The class/subclass is an alphanumeric code your business is assigned based on your business activities. To learn more about classification, view our Employer Classification Manual.

If you meet our multi-rating criteria, are a temporary employment agency, a non-exempt partner and executive officer in construction or have a rate modifier on one of your business activities, your statement will have two or more premium rates.

You must request and meet all of the following criteria to be eligible for multiple premium rates:

- You must properly segregate payroll for the business activity that you would like to have a separate rate for.

- Your business activities cannot form an integrated operation. The business activities cannot rely on each other for revenue generation or be offered together when you take your products to market, or form one line of production that equals one outcome.

- The business activity must be significant enough, having a sufficient share of the payroll.