Schedule 2 employers are self-insured and are therefore liable to fund all benefit payments for their injured workers and the associated administrative costs. Schedule 2 employers are classified under three groups for the purpose of billing the administration charges:

- Provincially-regulated employers;

- Federally-regulated employers; and

- Employers covered under the Government Employees Compensation Act (GECA).

The WSIB bills employers in these groups each month for their benefit payments and the associated administration expenses using the applicable administration rate.

Outlined below are the steps involved in determining the Administration Rates.

Step 1 – Determining Administrative Expenses for Schedule 2 Employers

The WSIB takes the total Schedule 2 expenses and allocates them among the three employer groups proportionally based on the benefit costs of each group.* The WSIB also allocates collective expense items applicable to Schedule 2 employers (such as interest on delayed payments, benefit overpayments and more).**

*Note: Costs related to prevention division expenses, the Occupational Health and Safety Act and Ministry of Labour are only allocated to provincially-regulated employers.

**Note: Bankruptcy costs are not allocated to GECA Employers.

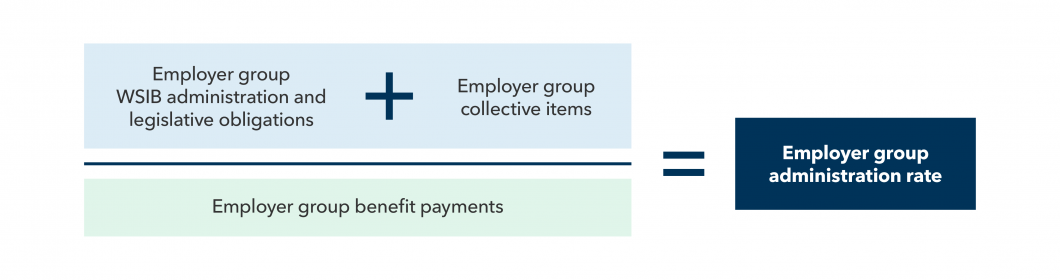

Step 2 – Determining the Administration Rate for Each Employer Group

The WSIB determines expenses for each of the three Schedule 2 employer groups and determines the Administration Rate to charge.

This is done using the following formula:

In 2020 and 2021, a charge to cover the Schedule 2 COVID-19 costs will be added to the administration rate.

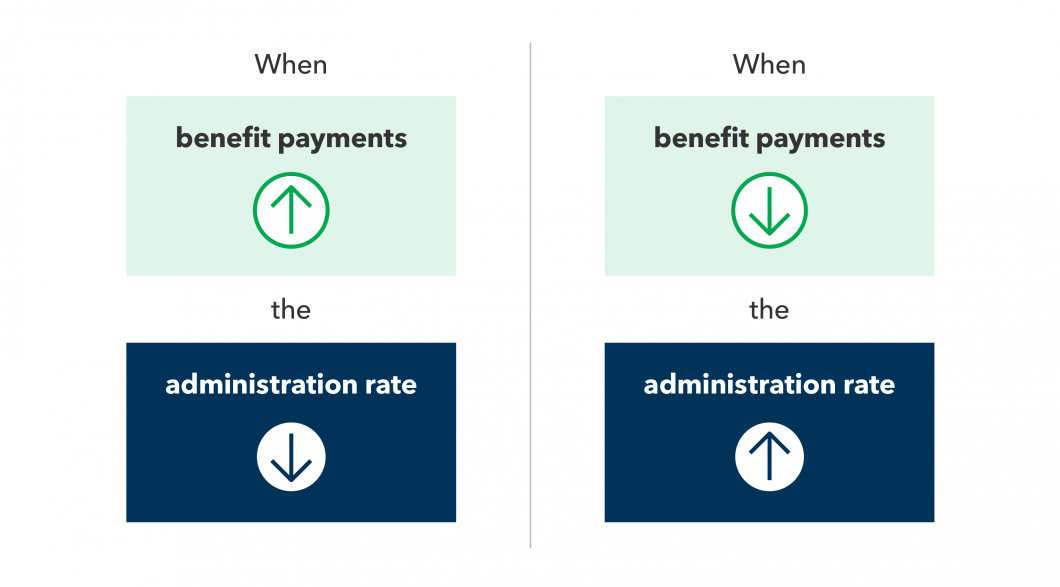

Remember: Because the Administration Rate is a percentage of administration expenses divided by benefits paid, when benefit payments for a group go up, the Administration Rate goes down and when benefit payments go down, the Administration Rate rises. It is important that employers consider the Administration Rate as a whole instead of focusing solely on expenses or benefits in isolation.

Communicating the Administration Rates

We have three key communications about Schedule 2 Administration Rates:

- Provisional Administration Rates – Set at the end of the previous year based on forecasts for the year ahead and used to charge employers on a monthly basis. For example, the 2020 Provisional Administration Rates were set in 2019 and posted online in early 2020.

- Latest Forecast – Communicated at the same time as Provisional Administration Rates based on updated information about the year prior. For example, when the 2021 Provisional Administration Rates were communicated, this was accompanied by an update with the Latest Forecast of the 2020 Administration Rates.

- Actual Administration Rates – Communicated in August of the next year based on final financial figures. An adjustment may be made to reflect differences between the Provisional Administration Rate that was billed to employers. The Actual Administration Rate for 2020 will be communicated in the summer of 2021.

For More Information

Hopefully, this helped you understand how Schedule 2’s Administration Rates are determined.

If you have questions about your administration rate, you can contact the Schedule 2 Employer Service Centre at 416-344-3646 or toll-free at 1-800-387-0750.