Policy

This policy only applies select types of drivers in the transportation industry. Unless otherwise indicated, “workers” only means workers who drive.

When a principal in the transportation industry hires owner-operators considered workers by the WSIB or by the principal, the labour portion of the contract is less than 100% since the owner-operators own or lease vehicles. In this case, the WSIB applies fixed percentages of the contract value, depending on the type of vehicle, to determine the labour portion of the contract.

The insurable earnings reported to Ontario by out-of-province transportation employers are based on pro-rating the worker’s earnings according to mileage driven in Ontario.

This policy should be read in conjunction with 14-02-08, Determining Insurable Earnings.

Purpose

The purpose of this policy is to provide guidelines on determining insurable earnings in the transportation industry.

Guidelines

Definitions

For the purpose of this policy, "transportation industry" includes the trucking, pilot car, courier, and taxi industries, unless specifically mentioned otherwise.

The "principal" is the person awarding or letting a contract to (i.e., purchasing services from) a contract driver.

"Contract driver" is a person who drives under contract. He/she may be a worker or may be ruled an independent operator by the WSIB.

An owner-operator is a contract driver who owns their own vehicle, or leases a vehicle with a specified lease-to-purchase provision.

The WSIB applies different methods to calculate insurable earnings for drivers in the transportation industry depending on whether the person

Maximum amount of insurable earnings

Employers report all insurable earnings of transportation drivers who work exclusively in Ontario up to the annual maximum on insurable earnings, which is set each year by the WSIB, see 14-02-08, Determining Insurable Earnings.

Determining the status of contract drivers

If a contract driver in the transportation industry does not employ workers and is not;

then the contract driver and the principal are required to complete the relevant questionnaire used by the WSIB to determine whether the driver is a worker or an independent operator for WSIB purposes. For information about determining a person’s status as a worker or an independent operator see, 12-02-01, Workers and Independent Operators.

Contract driver ruled an independent operator

Where a contract driver in select business activities in the transportation industry (specifically trucking, courier, and rideshare) is ruled an independent operator by the WSIB, the status determination as an independent operator will apply to all subsequent contracts where the individual uses the same vehicle. If the individual changes vehicles, a new questionnaire will be administered and the status determination will again apply to all subsequent contracts where the same vehicle is used. The independent operator has the option to voluntarily apply for optional insurance from the WSIB at any time, see 12-03-02, Optional Insurance.

Principal responsible to report earnings

Contract drivers considered workers

When a principal in the transportation industry or the WSIB considers a contract driver to be a worker, the principal who purchases the contracted service must report the worker’s earnings based on the labour portion of the contract value and pay premiums on those earnings.

Trucking, courier, and fast food delivery drivers

For contract trucking, courier, and fast food delivery drivers who are not owner-operators and who are considered workers, the labour portion is considered to be 100% of the total value of the contract, subject to the maximum insurable earnings ceiling.

NOTE

Fast food delivery drivers are not part of the transportation industry. These delivery drivers are considered to be workers by the WSIB whether or not they are owner-operators.

For contract trucking, courier, and fast food delivery drivers who are owner-operators and who are considered workers, the principal reports the labour portion of the owner-operator’s earnings as:

subject to the annual maximum on insurable earnings.

Taxi drivers

For all contract taxi drivers who are considered workers, the principal reports the labour portion of the contract, which is generally the worker’s portion of an agreed split of the fares collected, subject to the annual maximum on insurable earnings.

Retroactive liability for unregistered contract drivers under s.141

If a contract driver who is not registered as an employer with the WSIB for any portion of the period under contract with the principal is found to have employed workers, then the principal is liable to pay the premiums retroactively for the insurable labour portion of the contract between the principal and the contract driver. These insurable earnings are added back to the principal’s account under s.141(1)-(2), and (4).

The policy, 14-02-06, Employer Premium Adjustments, determines the extent of the add-back of premiums to the principal.

For the purpose of adding back earnings under s.141(2), the labour portion of the contract is determined in the same manner as described above under "Contract drivers considered workers."

Determining reporting requirements for Ontario-based employers

Ontario-based employers in the trucking, pilot car, courier, and bus industries with workers driving in more than one Canadian jurisdiction must contact the relevant workers’ compensation board(s) to determine how to report earnings and pay premiums according to:

even if they do not pick up or deliver goods.

In order to determine if the driver meets the reporting requirements for other jurisdictions, the employer must determine if the driver is covered in that jurisdiction. For information on non-resident workers, see 12-04-12, Non-Resident Workers.

Reporting the earnings of interjurisdictional drivers

Ontario-based trucking, pilot car, courier, and bus employers report the earnings of interjurisdictional drivers under either the IJA, or the optional AAP.

The following procedures under the IJA and AAP apply only to drivers working for Ontario-based employers. Ontario-based employers with workers who are not drivers and who are employed in other jurisdictions are required to maintain accounts and to pay premiums to the relevant jurisdictions.

Reporting earnings under the IJA for Ontario-based employers

The IJA specifies methods for reporting earnings of all workers whose employers are registered in more than one Canadian jurisdiction, see 14-02-12, Insurable Earnings - Interjurisdictional Agreement. The United States (US) is not a co-signator to this agreement.

If an Ontario-based employer has a driver travelling through a jurisdiction which does not require the employer to report earnings to that jurisdiction, the earnings based on mileage travelled in that jurisdiction are reported to the WSIB.

Total gross earnings below the maximum

Where the driver’s total gross earnings from all jurisdictions is below the Ontario insurable maximum, the employer reports earnings and pays premiums to each jurisdiction in which work is performed, including Ontario. Ontario premiums are based on the full amount of the worker’s earnings for work performed in Ontario.

Total gross earnings exceed the maximum

When the driver’s total gross earnings from all jurisdictions exceed the annual maximum for Ontario, the Ontario maximum is pro-rated based on the mileage travelled to avoid duplication of premiums. Earnings in excess of the pro-rated maximum can be deducted as non-insurable earnings.

Under the mileage-based formula, the driver’s insurable Ontario earnings are calculated as follows:

Example: Total earnings exceed the maximum

An Ontario-based employer has a driver considered a worker who had earnings of $75,000 driving in Ontario, and $45,000 driving in Manitoba. The employer reported the $75,000 earned in Ontario to the Ontario Board, and $45,000 to the Manitoba Board. The worker’s total gross earnings ($120,000) from all jurisdictions exceeded Ontario’s annual maximum of $85,200 (2015). The worker’s total gross earnings are therefore subject to pro-ration under the mileage-based formula.

The worker drove 60,000 kilometers in Ontario and 40,000 kilometers in Manitoba for a total of 100,000 kilometers. The pro-ration is calculated as follows

The employer has already reported $75,000 in earnings to Ontario. Therefore, the employer can now deduct the difference ($23,880) between the amount reported to Ontario ($75,000) and the pro-rated maximum ($51,120) as non-insurable earnings in Ontario.

Reporting earnings under the AAP

The AAP is an optional method under the IJA of reporting earnings and paying premiums for interjurisdictional workers in the trucking, pilot car, courier, and bus industries who travel through multiple Canadian jurisdictions.

Under the AAP, interjurisdictional trucking, pilot car, courier, and bus employers may opt to report earnings and pay premiums for a worker to the jurisdiction in which the worker resides, rather than to all the jurisdictions through which the worker travels. A special application must be made to participate in this optional procedure. For more details, see 14-02-13, Alternative Assessment Procedure for Interjurisdictional Trucking & Transport Industry.

Example: Reporting earnings under the AAP

Apex Trucking Ltd. (Apex) has chosen to participate in the AAP. Apex is located in Ontario and hauls freight from Ontario to Manitoba. Apex’s drivers reside in Ontario. Apex reports their earnings, and pays premiums to Ontario, the Assessing Board. The Manitoba Board is the Registering Board for identification purposes but Apex does not report earnings or pay any premiums to Manitoba for these workers. For definitions of Assessing and Registering Boards, see 14-02-13, Alternative Assessment Procedure for Interjurisdictional Trucking & Transport Industry.

If the gross insurable earnings of an Apex driver exceed the Ontario annual maximum, excess earnings are calculated in the usual manner according to 14-02-08, Determining Insurable Earnings.

Out-of-province employers with drivers in Ontario

Out-of-province trucking, pilot car, courier, and bus employers are responsible to report earnings and pay premiums to the WSIB for:

who pick up or deliver goods in Ontario. For information on non-resident workers, see 12-04-12, Non-Resident Workers.

The employer calculates the Ontario insurable earnings by taking the driver’s gross insurable earnings in all jurisdictions and pro-rating those earnings according to the mileage travelled in Ontario. All reporting of earnings and payment of premiums is subject to verification upon audit.

Total gross insurable earnings over the maximum

If the out-of-province employer reports earnings and pays premiums under the IJA, and the driver’s gross insurable earnings reported to all jurisdictions including Ontario exceed the Ontario annual maximum, the mileage-based pro-rating formula applies (see example under "Reporting earnings under the IJA: Total gross earnings exceed the maximum").

If the out-of-province employer elects to report earnings and pay premiums under the AAP, and the driver’s gross insurable earnings reported to Ontario exceed the Ontario maximum, excess earnings are calculated in the usual manner in accordance with 14-02-08, Determining Insurable Earnings.

Example: Total gross insurable earnings over the maximum

Foxboro Transport Inc. (Foxboro) is located in Quebec. Foxboro sends its trucks and drivers into Ontario each week to pick up and deliver machined parts. Some of the drivers working for Foxboro are Ontario residents. All Foxboro’s drivers have a substantial connection with Ontario as determined by 12-04-12, Non-Resident Workers. As a result, Foxboro must report earnings and pay premiums to Ontario based on the drivers’ mileage in Ontario.

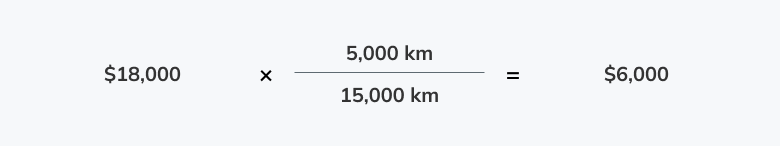

For a given reporting period, the driver earns $18,000 in both Quebec and Ontario. The driver drove 15,000 kilometers in total, with 5,000 kilometers driven in Ontario.

The insurable earnings reported to Ontario for this reporting period are calculated as follows:

If Foxboro does not participate in the AAP and a driver’s gross insurable earnings reported to all jurisdictions including Ontario exceed the Ontario annual maximum, the mileage-based pro-rating formula applies (see example under "Reporting earnings under the IJA: Total gross earnings exceed the maximum").

If Foxboro participates in the AAP and a driver’s insurable earnings reported to Ontario exceed the Ontario annual maximum, excess earnings are calculated in the usual manner in accordance with 14-02-08, Determining Insurable Earnings.

Driving outside Canada

When any driver of an Ontario-based employer drives outside Canada (i.e., such as the US & Mexico), the employer must report the earnings of what that driver earned outside Canada to the WSIB for premium purposes.

Application date

This policy applies to decisions with respect to the calculation of premiums based on earnings earned from July 1, 2023.

Document history

This document replaces 14-02-09, dated January 2, 2018.

This policy was previously published as:

14-02-09 dated January 1, 2015

14-02-09 dated January 2, 2014

14-02-09 dated October 12, 2004

14-02-09 dated July 19, 2004.

References

Legislative authority

Workplace Safety and Insurance Act, 1997, as amended

Sections 2(1), 54, 78, 87, 88(1) & (3), 141, 159, 160

Minute

Administrative

#3, May 19, 2023, page 613